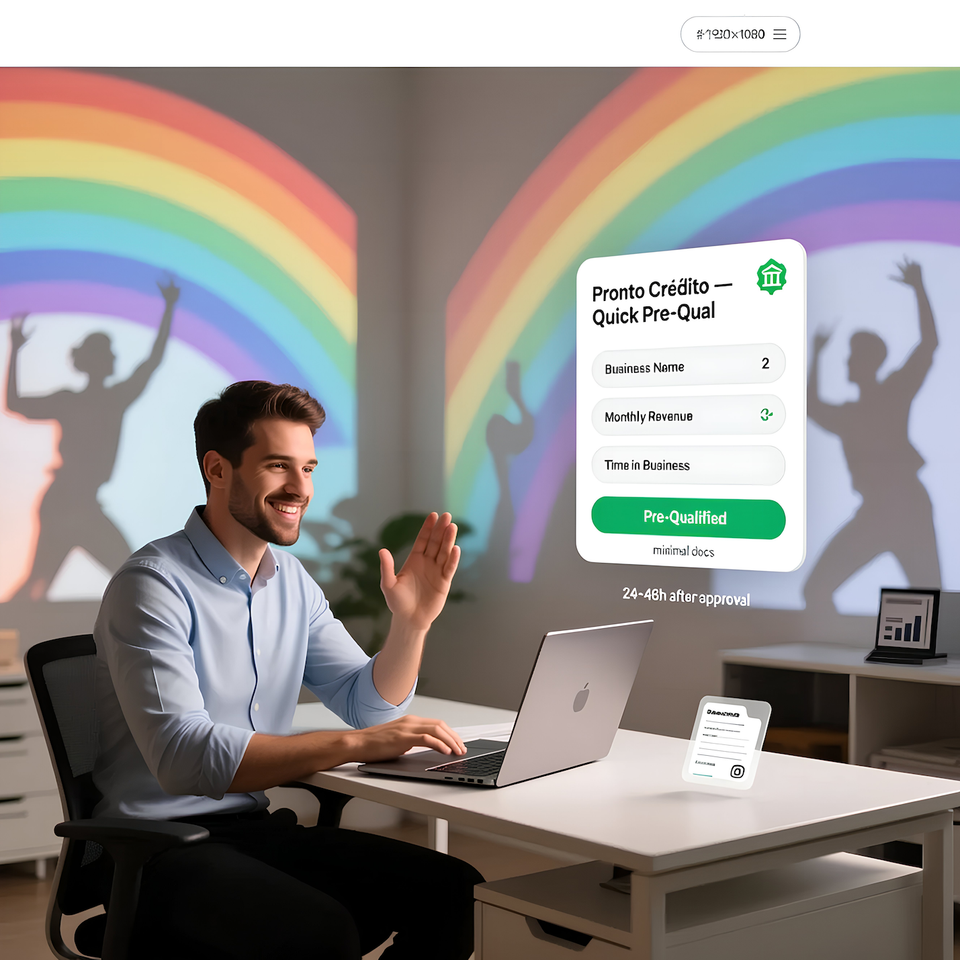

4-Steps to Get Funded with Pronto Crédito

Pre-qualify in minutes, upload recent bank and card-processing statements, review a clear factor-rate offer, and get funded fast—

repayment flexes as a percentage of your sales.

Step-1)

Quick pre-qual & consult

Complete a short pre-qualification and hop on a call to confirm fit. MCAs are designed for speed with minimal docs and can fund fast once approved.

Step-2)

Upload your docs (takes minutes)

Have these ready to keep things moving: last 3–6 months business bank statements, last 3–6 months card-processing statements (if applicable), government ID, and a voided business check. These are standard across reputable MCA providers and help verify revenue consistency

Step-3)

Underwriting & clear offer

We review cash-flow trends and business health, then present an offer showing the advance amount, the pricing (factor rate), and the remittance/holdback structure—plain-English and upfront. (Factor rates are the standard way MCAs price total payback; holdback is the agreed % of sales used for remittance.)

Step-4)

Fast funding & flexible remittance

On approval, funds are deposited quickly. Industry-standard MCAs repay automatically as a percentage of daily card sales until the total is satisfied; Pronto Crédito can restructure this into a predictable monthly schedule when appropriate to match your cash-flow needs.